How Trading Indicator can Save You Time, Stress, and Money.

Wiki Article

Facts About Trading Indicator Revealed

Table of ContentsThe 10-Minute Rule for Trading IndicatorThe Main Principles Of Trading Indicator Unknown Facts About Trading IndicatorThe Only Guide to Trading Indicator

Murphy's work, "Technical Evaluation of the Financial Markets" published by the New york city Institute of Money in 1999. This work consists of among the very best explanations about the advantage of the exponentially heavy relocating average over the basic moving standard. It goes as complies with:"The exponentially smoothed moving ordinary addresses both of the problems related to the easy relocating standard.It is a heavy moving standard. However while it designates lesser relevance to previous price information, it does consist of in its estimation all the data in the life of the instrument. Furthermore, the user has the ability to adjust the weighting to offer greater or lower weight to one of the most current day's price, which is included to a percentage of the previous day's worth.

Some Ideas on Trading Indicator You Need To Know

Chande recommended that the efficiency of a rapid moving average might be improved by utilizing a Volatility Index (VI) to adjust Related Site the smoothing duration when market problems transform. Volatility is the action of just how quickly or slowly costs alter over time. The volatility index shows the market's volatility forecasts for the following 30 days.Offered below is the technique for determining the variable moving average: where, = 2/ (N + 1)VI = Procedure of volatility or pattern toughness, N = Customer determined smoothing duration, VMA = The previous worth of the variable moving average Let us now talk about some known moving ordinary trading techniques.

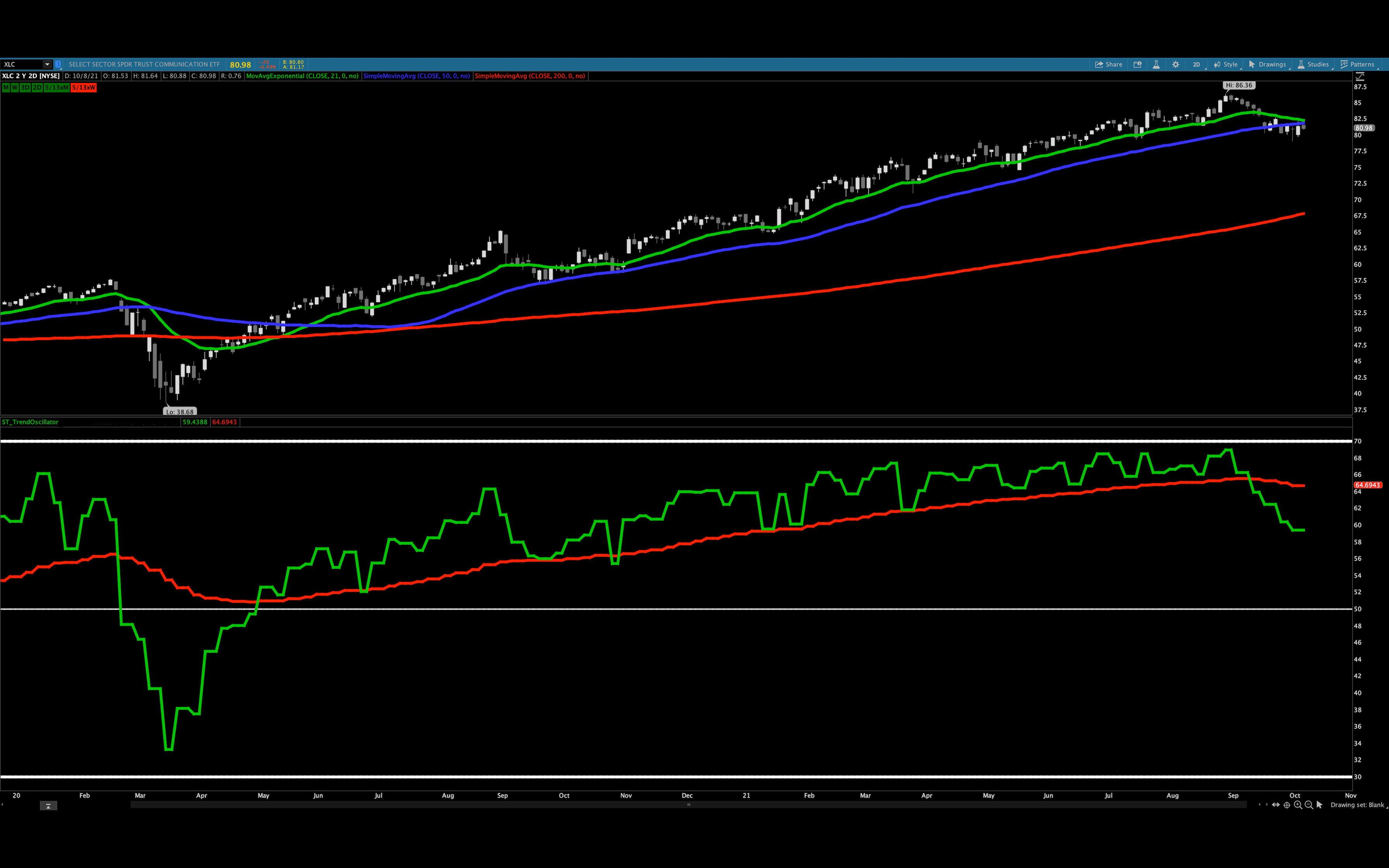

The three-way relocating ordinary approach includes plotting 3 different relocating averages to generate buy as well as market signals. TRADING INDICATOR. This relocating typical method is much better equipped at managing false trading signals than the twin relocating ordinary crossover system. By see this using three relocating standards of various lookback periods, the trader can verify whether the market has actually experienced a change in fad or whether it is only resting temporarily before continuing in its previous state.

The 3rd relocating standard is used in combination with the various other two moving averages to their explanation verify or refute the signals they produce. When safety starts an uptrend, faster relocating standards (short term) will certainly begin increasing a lot earlier than the slower moving averages (long term).

Excitement About Trading Indicator

To show this relocating typical method we will make use of the 10 day, 20 day and 30 day straightforward moving standards as plotted in the graph below. For shorter time frames (one hour bars or faster), the rapid moving standard is chosen due to its propensity to follow the rate contour carefully (e.

4, 9, 18 EMA or 10, 25, 50 EMA). Triangular moving average, Take into consideration point 'A' on the graph above, the three moving standards alter direction around this factor.

A signal to offer is set off when the rapid moving typical crosses listed below both the medium and also the slow moving standards. This reveals a short term change in the fad, i. e. the average cost over the last 10 days has dropped below the average cost of the last 20 and also one month.

The Best Strategy To Use For Trading Indicator

The three-way relocating ordinary crossover system creates a signal to sell when the slow relocating standard is over the tool relocating standard and also the tool relocating standard is over the fast relocating standard. When the quick relocating ordinary goes over the tool moving standard, the system exits its position. Therefore, unlike the dual relocating ordinary trading system, the three-way relocating typical system is not always on the market.Extra hostile investors would not wait on the confirmation of the trend and also rather enter into a position based upon the quick moving average crossing over the slow-moving and also average moving averages. One may also get in positions at various times, for instance, the trader can take a particular number of long positions when the quick MA goes across above the tool MA, then occupy the following collection of lengthy settings when the quick MA crosses above the slow MA.Finally much more long placements when the tool crosses over the slow MA.

Report this wiki page